- Home

- About

- Contact

- Services

- Art Competition

- Community Project Requests

- Congressional Commendations

- Flags

- Assistance with a Federal Agency

- Internships

- Military Academy Nominations

- Passports

- Presidential Greetings

- Tours and Tickets

- The Congressional Award

- Grants

- Water Resources Development Act 2026

- Additional Services and Resources

- Media

- Legislation

- Issues

- Resources

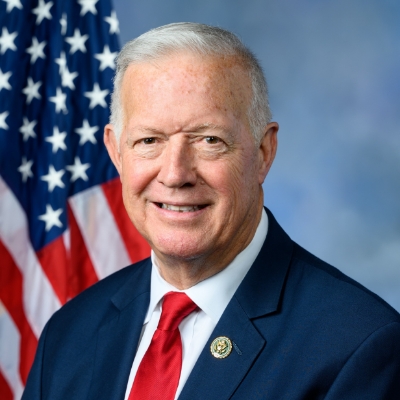

U.S. REPRESENTATIVE

Randy Weber

Proudly Serving Texas' 14th District

U.S. REPRESENTATIVE

Randy Weber

Proudly Serving Texas' 14th District

Press Releases

Weber Introduces Deny Amnesty Credits Act

Washington, DC,

March 11, 2015

In an effort to combat the President’s actions granting executive amnesty, Congressman Randy Weber (R-TX-14) introduced the Deny Amnesty Credits Act of 2015 (H.R. 1332), which would prevent those who are granted deferred action under Deferred Action for Childhood Arrivals (DACA) and the Parents of Americans and Lawful Permanent Residents (DAPA) from qualifying for the Earned Income Tax Credit (EITC) and the Child Tax Credit (CTC). “Our President has trampled on our Constitution and circumvented Congress to ensure his political legacy far too many times. In an effort to dismantle his amnesty agenda, I have introduced legislation that will stop billions in tax credits from being given to those who are here illegally.” The President’s executive amnesty would give illegal aliens access to Social Security numbers and the ability to receive as much as $35,000 dollars on their tax returns from the U.S. Treasury. According to the Congressional Budget Office, this could cost American taxpayers $10.2 billion because of an executive program never authorized by Congress. “Instead of working with Congress to secure our borders and uphold the law of the land, this Administration is offering executive amnesty and tax credits to illegal aliens. We must hold this Administration accountable for actions that circumvent Congress’ constitutional power of the purse and could cost billions of taxpayer dollars.” The Deny Amnesty Credits Act of 2015 (H.R. 1332) currently has nine co-sponsors: Rep. Walter Jones (NC-3), Rep. Ted Yoho (FL-3), Rep. Mo Brooks (AL-5), Rep. Tom Rice (SC-7), Rep. Bradley Byrne (AL-1), Rep. Bill Posey (FL-8), Rep. David Schweikert (AZ-6), Rep. Brian Babin (TX-36), Rep. Lou Barletta (PA-11). To read the bill text, click here. ### |