|

Individual Tax Rebates

This bill provides immediate cash relief for Americans.The full credit amount - $1,200 for individuals, $2,400 for couples, and $500 for children - is available for those with incomes at or below $75,000 for individuals, $112,500 for heads of household, and $150,000 people who file jointly. The credit phases out above those thresholds and will be phased out completely for single taxpayers with incomes exceeding $99,000 and $198,000 for joint filers.

As long as a person has a valid Social Security number, they can receive the credit. This means workers, those receiving welfare benefits, Social Security beneficiaries, and others are all eligible.

Unemployment Expansion

This bill includes approximately $250 billion to expand access to unemployment benefits. This legislation helps those who are not eligible for regular unemployment insurance by creating a new Pandemic Unemployment Assistance program. This is critical for those not traditionally eligible for unemployment insurance, such as self-employed and independent contractors, like gig workers and Uber drivers, as well as those who are unable to work or telework as a result of the coronavirus pandemic.

The legislation provides an additional payment to each recipient of $600 per week to people receiving unemployment insurance or Pandemic Unemployment Assistance recipients for 4 months beginning April 1 through July 31, 2020.

We also provide funding to reimburse nonprofits and government entities that are not part of the state unemployment system for 50% of the costs they incur through December 31, 2020 to pay unemployment benefits.

Loans & Forgiveness to Small Businesses

This bill provides$349 billion in loans for small businesses to help keep their doors open and their employees on the payroll. Businesses can use these loans for payroll support, paid sick or medical leave, insurance premiums, and mortgage, rent, and utility payments.

Businesses eligible for loans includes small businesses, 501(c)(3) nonprofits, including churches. We also provide this relief for sole-proprietors, independent contractors, and other self-employed individuals.

Borrowers should go to their traditional lender, their community bank or credit union, since the bill gives delegated authority, which means that loans can be originated by most financial institutions.

Support for Medical Professionals on the Front Lines

This legislation provides critical support to the hospitals and health care workers on the front lines of this fight. We provide:

- $100 billion for hospitals and providers to reimburse health care expenses or any lost revenue they might have seen due to COVID-19

- $16 billion to procure personal protective equipment (PPE), ventilators, and other medical supplies for federal and state response efforts.

- $11 billion for the Public Health Emergency Fund for the manufacturing, production, and purchase of vaccines, therapeutics, diagnostics, and other medical or preparedness needs.

- $4.3 billion for the Centers for Disease Control and Prevention (CDC), including another $1.5 billion for direct allocation to the states

- $1 billion for research into an effective vaccine.

- $17 billion for research and promoting domestic manufacturing capacity to decrease reliance on a global supply chain

- $100 million for the Department of Energy to use their supercomputers to research possible COVID-19 treatments and vaccines

This legislation also expands coverage of COVID-19 diagnostics to all Americans, by ensuring that tests and all future vaccines are covered by insurance. States are also allowed the option to provide a future vaccine to uninsured populations, through the Medicaid program.

Loans to Distressed Industries

This legislation also protects the large businesses who are being hit especially hard by this crisis and employ millions of Americans. This legislation allocates $500 billion to what is called an Exchange Stabilization Fund (ESF), which is basically an emergency reserve fund that provides the Treasury Secretary with the authority to distribute emergency funding. That includes up to $46 billion to assist air carriers and businesses critical to our national defense.

To be clear, this is not a bailout. The fund provides loans that must be paid back, and the loans are to Americans who, through no fault of their own, are in economic jeopardy. Additionally, this comes with strict oversight to prevent stock buy-backs, executive pay raises, and layoffs.

Remember: an American laid off from a big business is no different than an American laid off from a small business.

Housing Support

We are also addressing significant housing challenges that have arisen as a result of this crisis. This legislation provides:

$5 billion for Community Development Block Grants with additional flexibility to meet the needs of individual communities fighting this virus.

$1.25 billion in additional funding for Tenant Based Rental Assistance programs to assist more families in securing stable housing during this emergency and help assisted households who may lose income during the outbreak.

$1 billion for Project Based Rental Assistance to assist public housing authorities and property owners in preventing the spread of COVID-19 and helping residents who lose income due to the outbreak.

$4 billion for Emergency Homeless Assistance Grants that go directly to local governments to help provide shelter and basic facilities.

Additionally, we are protecting homeowners and renters from foreclosure and eviction by prohibiting foreclosures on any federally backed mortgages for 60-days. This bill also allows borrowers affected by COVID-19 to shift any missed payments to the end of their mortgage, with no added penalties or interest, for 180 days.

This bill halts evictions for renters in properties with federally backed mortgages for 120 days and gives relief to multifamily property owners through forbearance on any federally backed mortgage.

Education

Education has also been disrupted as a result of the coronavirus pandemic, so there are specific measures in this bill to provide relief to our education system and students.

This legislation provides needed relief to college students to ensure they are not harmed by colleges’ decisions to switch to online delivery models or close outright in the middle of the semester. Specifically, the bill provides direct financial relief to many student loan borrowers by pausing their monthly repayment requirements for six months with no penalty.

We are also providing schools the flexibility to ensure this interrupted or unfinished semester does not stop their students' ability to continue class in the future. Students will not be on the hook for financial aid distributed to them when the pandemic forced them to drop out mid-term

Additional Recovery Funding

There is also additional relief for other distressed systems and critical agencies responding to this pandemic, including:

$36.1 billion for our transportation systems such as airports, transit, and passenger rail;

$45 billion for the Federal Emergency Management Agency’s Disaster Relief Fund;

$31 billion for K-12 schools, colleges, and universities;

$5 billion for Community Development Block Grants;

$19 billion for veterans’ assistance;

$25.1 billion for nutritional assistance for senior citizens, women, children, and low-income families;

$150 billion for states and localities.

Small Business Relief in Coronavirus Legislation – FAQ

When is the application deadline for the Paycheck Protection Program?

Applicants are eligible to apply for the Paycheck Protection Program loan until June 30th, 2020.

Where can I apply for the Paycheck Protection Program?

You can apply for the Paycheck Protection Program (PPP) at any lending institution that is approved to participate in the program through the existing U.S. Small Business Administration (SBA) lending program and additional lenders approved by the Department of Treasury. This could be the bank you already use, or a bank or credit union near you. You do not have to visit any government institution to apply for the program. Just call your bank or find SBA-approved lenders at SBA.gov

Who is eligible for the loan?

You are eligible for a loan if you are a small business that employs 500 employees or fewer, or if your business is in an industry that has an employee-based size standard through SBA that is higher than 500 employees. In addition, if you are a restaurant, hotel, or a business that falls within the North American Industry Classification System (NAICS) code 72, “Accommodation and Food Services,” and each of your locations has 500 employees or fewer, you are eligible. Tribal businesses, 501(c)(19) veteran organizations, and 501(c)(3) nonprofits, including religious organizations, will be eligible for the program. Independently owned franchises with under 500 employees, who are approved by SBA, are also eligible.

I am an independent contractor or gig economy worker, am I eligible?

Yes. Sole proprietors, independent contractors, gig economy workers, and self-employed individuals are all eligible for the Paycheck Protection Program.

What is the maximum amount I can borrow?

The amount any small business is eligible to borrow is 250 percent of their average monthly payroll expenses, up to a total of $10 million. This amount is intended to cover 8 weeks of payroll expenses and any additional amounts for making payments towards debt obligations. This 8 week period may be applied to any time frame between February 15, 2020 and June 30, 2020. Seasonal business expenses will be measured using a 12-week period beginning February 15, 2019, or March 1, 2019, whichever the seasonal employer chooses.

How can I use the money to ensure the loan will be forgiven?

The amount that may be forgiven is equal to the total expenses for payroll, and existing interest payments on mortgages, rent payments, leases, and utility service agreements. Payroll costs include employee salaries (up to an annual rate of pay of $100,000), hourly wages and cash tips, paid sick or medical leave, and group health insurance premiums.

When is the loan forgiven?

The loan is forgiven at the end of the 8-week period after you take out the loan. Borrowers will work with lenders to verify covered expenses and the proper amount of forgiveness.

What is the covered period of the loan?

The covered period extends from February 15, 2020 to June 30, 2020. Borrowers can choose which 8 weeks they want to count towards the covered period, which can start as early as February 15, 2020.

How much of my loan will be forgiven?

The purpose of the Paycheck Protection Program is to help you retain your employees, at their current base pay. If you keep all of your employees, the portion of the loan used for payroll and other covered expenses will be forgiven.

If you still lay off employees, the forgiveness will be reduced by the percent decrease in the number of employees. If your total payroll expenses on workers making less than $100,000 annually decreases by more than 25 percent, loan forgiveness will be reduced by the same amount. If you have already laid off some employees, you can still be forgiven for the full amount of your payroll cost if you rehire your employees by June 30, 2020.

|

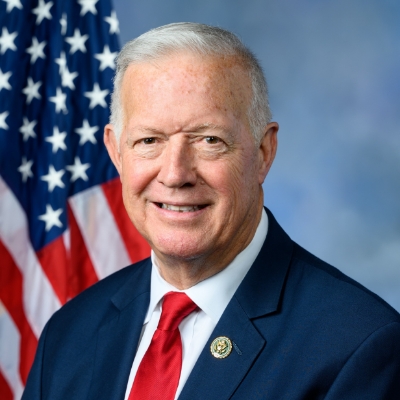

U.S. REPRESENTATIVE

Randy Weber

Proudly Serving Texas' 14th District

U.S. REPRESENTATIVE

Randy Weber

Proudly Serving Texas' 14th District